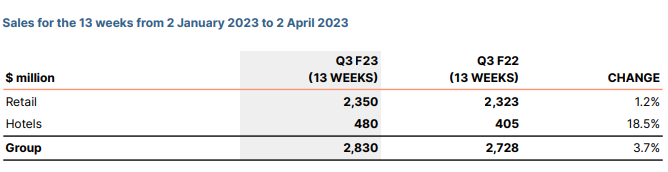

Endeavour Group announce Q3 results

Solid Group performance for the quarter, with stability across both Retail and Hotels

Endeavour Group Managing Director and CEO, Steve Donohue, said “The Group delivered a solid sales result across both Retail and Hotels in Q3. This quarter both segments were in

growth, with stable trading across our portfolio compared to the COVID-19 impacted prior year.

“Australians love socialising and our network of brands are a go-to for consumers, whether they are enjoying a great value meal at one of our hotels, or taking advantage of the best prices on a great range of drinks.

“Our Retail sales returned to growth in December and have continued to track ahead of last year over Q3. In-store sales drove this, growing by 2.8% in the quarter. Complementing this was a trend towards pick-up which represented 53% of online sales in the period, reflecting the convenience of our omnichannel offering.

“Customer sentiment remained strong. Notably, our My Dan’s membership program has continued to grow, reaching a significant milestone in the quarter with over 5 million active members. This reflects the popularity of the Dan Murphy’s offer and our famous Lowest Liquor Price Guarantee. In BWS, customers continue to embrace our local and convenient offering, reflected in an increase in transactions in the quarter. This was supported by another successful App Cooler promotion across January and February.

”In Hotels, food, bars and accommodation have all continued to be materially above the prior year in which COVID-19 impacted both customer demand and team availability levels. This was supported by over 100 live events held across the quarter, with ticketed events attracting over 38,000 patrons. Gaming has returned to pre-pandemic share of turnover, with low single-digit growth in the quarter.

“During the quarter Endeavour welcomed five new hotels, adding 16 bars, five bistros, seven accommodation rooms and 112 Electronic Gaming Machines to the portfolio. We also continued to make good progress on the redevelopment of the Brook Hotel in Queensland which will employ approximately 90 new team members, including 40 accommodation rooms and a new Dan Murphy’s which opened as Stage 1 of the development in February. In our premium Paragon Wine Estates portfolio we were pleased to announce the acquisition of the iconic Cape Mentelle winery in Margaret River.

“As we look ahead we continue to closely monitor customer choices in the context of the macroeconomic climate. We remain confident that we offer a great breadth of options and value for all social occasions and we will continue to tailor our offering as the environment requires.”

Retail

Retail sales for the third quarter remained strong at $2.4 billion, an increase of 1.2% on the previous year. Comparable sales also returned to growth through the period.

Customers continued to shop in stores at a higher rate compared to prior year, driving in-store sales growth of 2.8% in the quarter. New products continued to perform well, particularly benefiting the Ready-To-Drink (RTD) category, which was the fastest growing category in the quarter.

The investments we have made in our Pinnacle Drinks business see us well placed to meet changing customer preferences, offering exceptional value at all price points and providing capability to partner with suppliers to develop new products across categories. Our Oakridge Winery in the Yarra Valley was recently awarded 2023 Winery of the Year by The Real Review , which is a testament to the hard work of our Pinnacle team and the quality of our winery assets.

Promotional activity in the market remains elevated, particularly in the online channel, where we have focused on maintaining profitable sales as the market normalises. Consistent with H1, our online sales continue to be lower compared to the elevated prior year, however weekly sales were relatively stable across the quarter.

The benefits of our continuous investment in network expansion and renewal underpins our results. We’re also continuing to enhance the omnichannel experience for our customers, building our data and digital capability, improving our web and app platforms and continuing the roll out of Electronic Shelf Labels, which are now in place in 100 of our stores. During the quarter, we opened two Dan Murphy’s stores, six BWS stores and closed three BWS stores, ending the quarter with 1,701 stores. We continue to improve our store formats with seven renewals completed

in Dan Murphy’s and 16 in BWS. In addition, we completed 19 BWS upgrades, a program of lighter touch improvements.

Hotels

Hotels sales for the third quarter increased by 18.5% to $480 million, with strong growth of 31.5% in the first five weeks, followed by a growth rate of 11.5% in the final eight weeks. Weekly sales were relatively stable across the period, however comparatives to last year are distorted as we cycle an unusual trading period.

Comparable sales increased 16.3% for the quarter, with strong year on year growth in bars, food and accommodation as we cycled pandemic-related restrictions and team availability challenges last year. Patronage was further supported by the return of live sport and entertainment. Gaming sales growth continued to normalise from the elevated levels seen in the second half of F22, reflecting the cycling of the heightened demand in the prior year.

During the quarter, we added five hotels to our network; The Tower Hotel (Magill, SA), Beach Hotel (Seaford, SA), The Marine Hotel (Cardwell, QLD), Beachfront Hotel (Rapid Creek, NT) and Rainbow Beach Hotel (Rainbow Beach, QLD). In addition, we renewed three hotels and divested one (The Victory Hotel in Brisbane), with 353 hotels in total (including five managed clubs) at the end of the quarter.

Group & Outlook

Group

Capital expenditure for F23 is expected to be between $470 million and $520 million, which includes a higher level of hotel acquisitions relative to prior year, with 10 hotels acquired year to date.

As anticipated, rising interest rates will result in higher finance costs in H2, which are expected to range between $240 million to $260 million for the full year.

Outlook

As we continue into Q4 trading conditions have remained generally consistent with Q3, however we remain alert to the cost of living pressures impacting customers across Australia. Across our business we will continue to adjust and respond through our breadth of offerings that have something for everyone, whether they are socialising in our hotels or at home.

The contents of this F23 Third Quarter Trading Update are derived from the unaudited accounting records of Endeavour Group.