2020 US National Hop Report Breakdown January 2021

In December the United States Department of Agriculture released its National Hop Report. Yakima hop grower Eric Desmarais penned this analysis with some interesting insights into the growing dominance, and changes in leadership amidst, proprietary hops. It is reproduced here with permission. You can follow Eric here.

Although many of us look forward to 2021, we must reflect on 2020 and all the challenges hop growers faced throughout the season. Recently, the United States Department of Agriculture (USDA) released its annual National Hop Report on Dec. 22, showing a steep drop in pounds produced but significantly more acreage planted in 2020.

The report breaks down yields and acres harvested by variety and state for 2020, providing a glimpse into changes within the hop industry.

Pandemics, historical weather events, the continued rise of proprietary varieties, competitive proprietary hop breeding entities, and nascent but notable successes in the public variety space have all contributed to 2020 as an inflection point in the hop industry.

The brewing industry — and hence the hop industry — has undergone extraordinary changes in the last five years. As we move forward into 2021, a look back on the 2020 hop crop year from a statistical point of view, helps frame structural changes that are occurring, while also providing a snapshot of the 2020 crop year production.

Highlights

- 2020 Crop: Mother Nature takes her toll

- The continued rise of proprietary varieties

- Greater competition amongst proprietary hop variety developers; changing of the guard

- Flickers of hope in the public variety space

2020 Crop: Mother Nature Wreaks Havoc

Growers, dealers, and brewers will remember 2020 as one of the most significant and challenging years because of a pandemic, but they will also remember it for the historic weather anomalies and their effect on the 2020 hop crop.

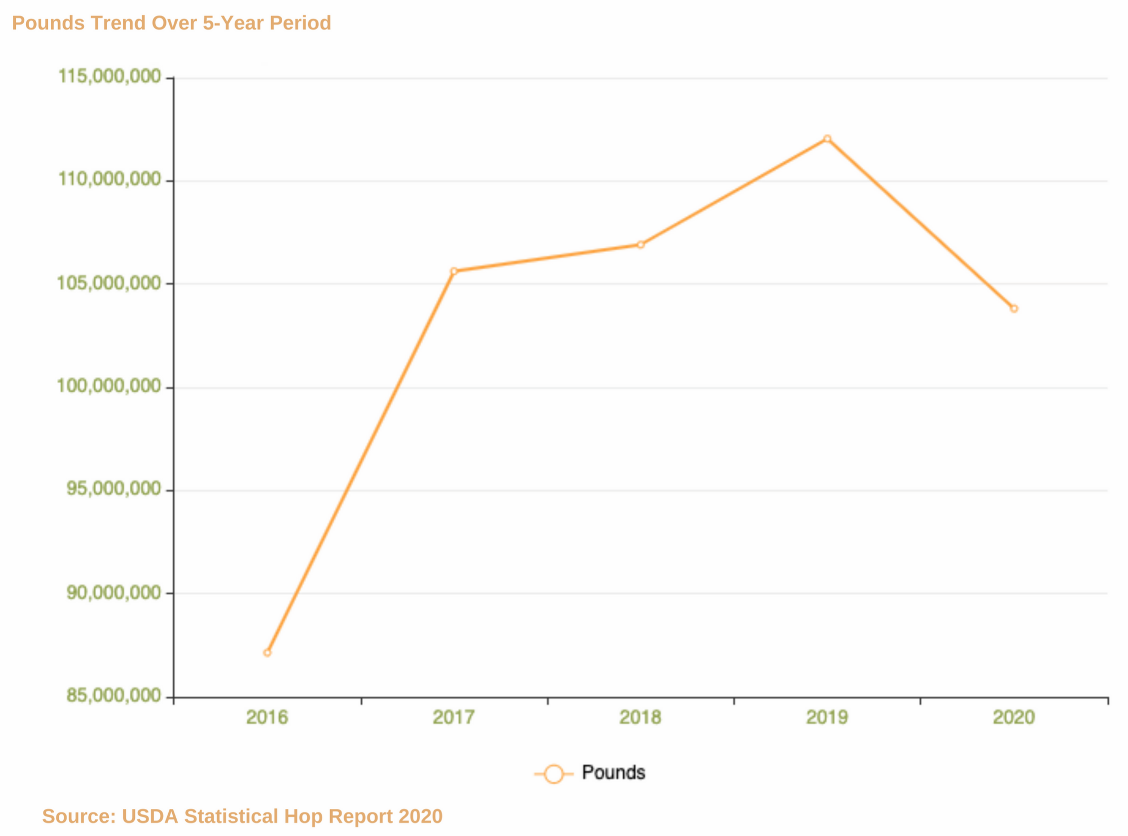

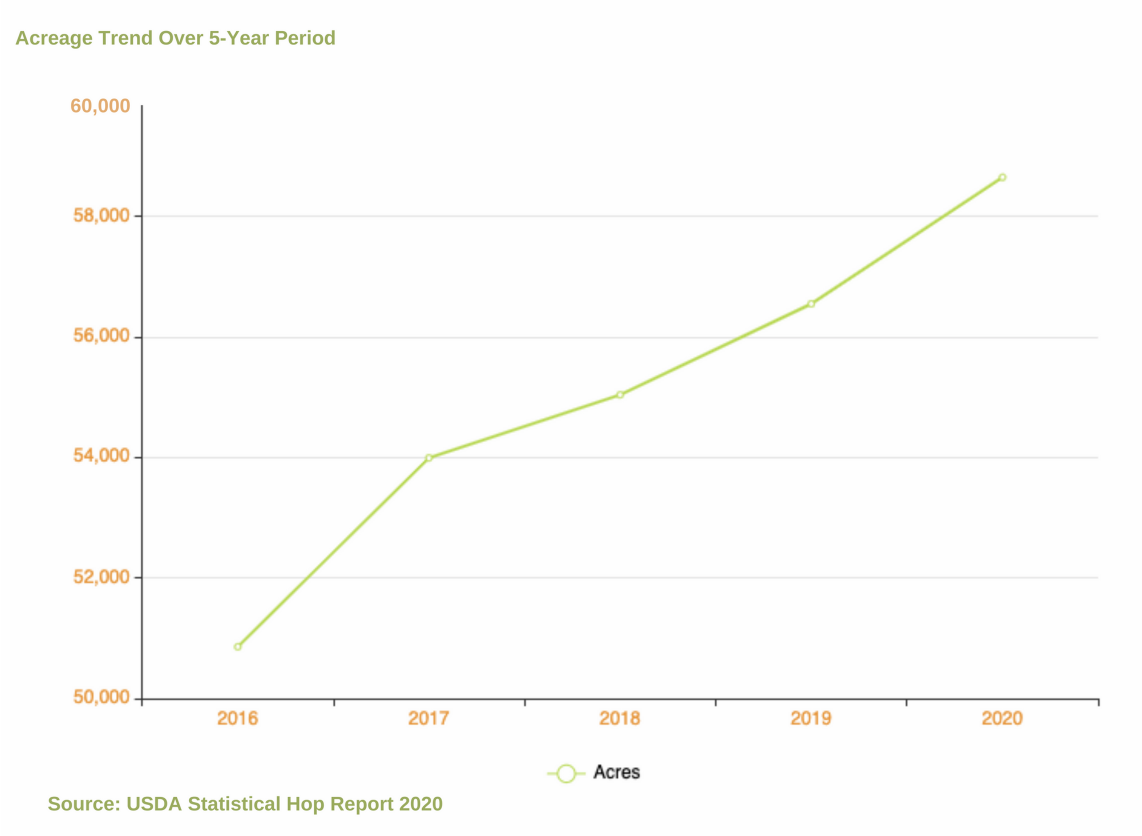

The 2020 harvest resulted in the smallest crop since 2016 in overall pounds produced but had the highest acreage base ever for the United States hop industry.

Pre-harvest weather conditions and a once-in-a-100-year windstorm that affected all three major hop growing states in the Pacific Northwest were the primary contributing factors to the crop decline in 2020.

Pre-harvest weather conditions and a once-in-a-100-year windstorm that affected all three major hop growing states in the Pacific Northwest were the primary contributing factors to the crop decline in 2020.

However, extenuating factors beyond Mother Nature also contributed to the decline. The ongoing structural shift from higher-yielding alpha varieties, to lower-yielding aroma varieties, certainly contributed as well.

In addition, some industry participants chose to reduce “string density” in certain varieties to curtail yield, in response to the pandemic and its effects on brewing output. While this did have an effect, it was a relatively small number of acres, and reductions in string density many times only causes minor reductions in yield. Overall, the effect of this was insignificant, but worthy of notation.

Across the industry, most growers in Washington and Idaho felt their yields were down 10% to 15% from their pre-harvest estimates. Oregon growers seemed to have fared better and had yields that approached long term averages.

However, the effect was dramatic for the U.S. hop industry, which typically doesn’t see yield variances of this magnitude from climatic events.

While the reduced yields from the 2020 crop were disappointing to growers, the overall effect will be that the 2020 crop will be much better aligned, size-wise, to the 2021 brewing needs, given the effects that COVID-19 has had on the brewing industry.

Proprietary Hop Varieties Continue Their Ascendency

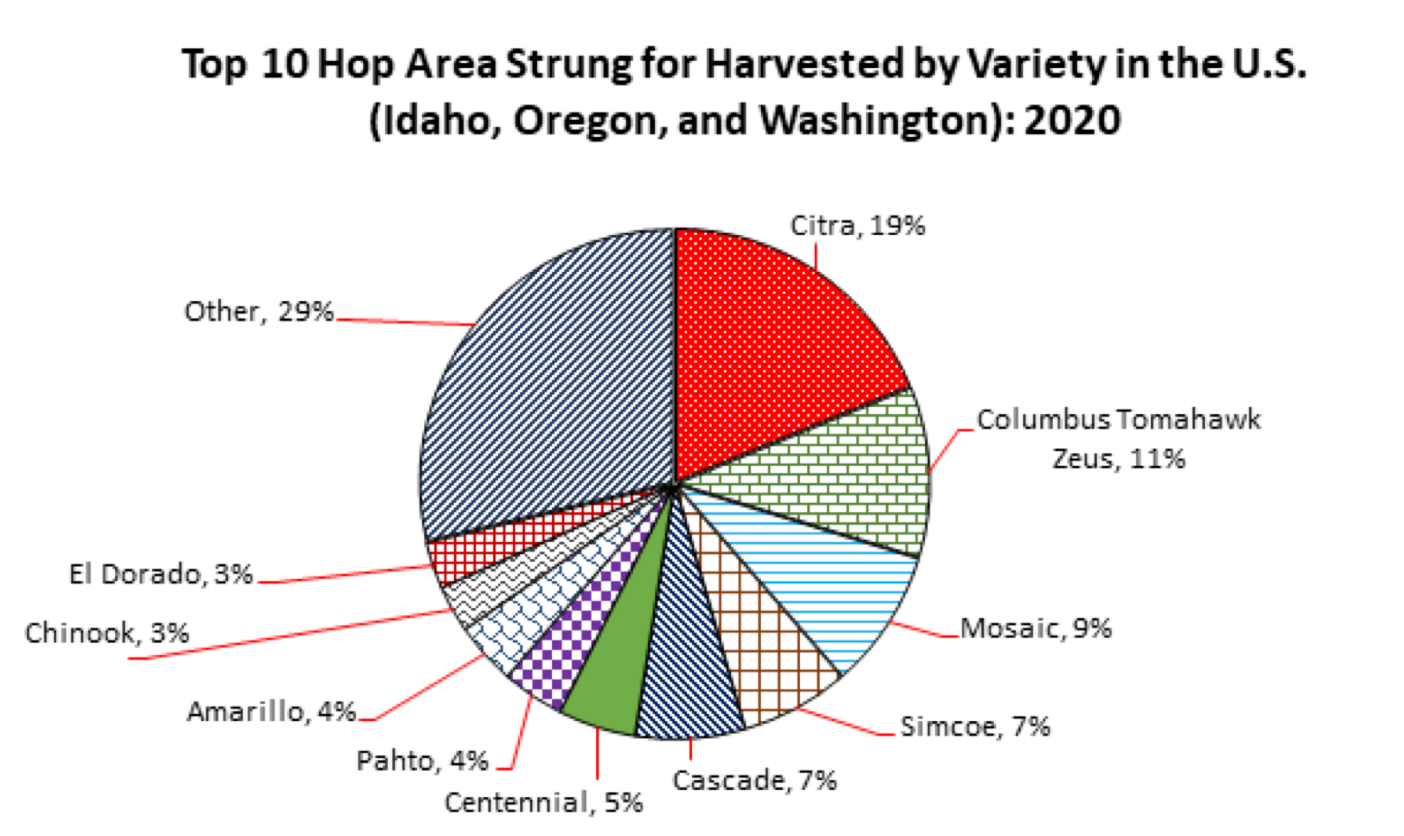

About 64% of the 2020 acreage of the top ten hop varieties strung for harvest 2020 were proprietary hop varieties, an all-time high.

However, proprietary hop varieties are seeing their first major rotation into new varietal leadership:

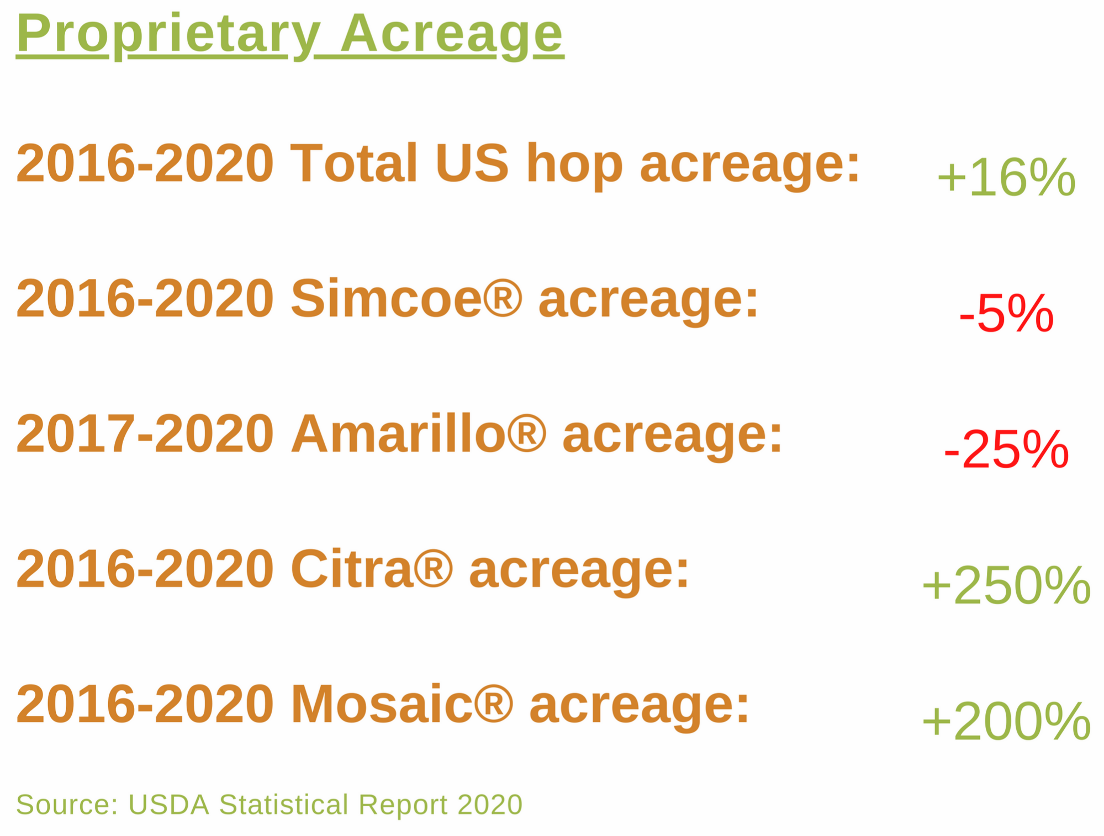

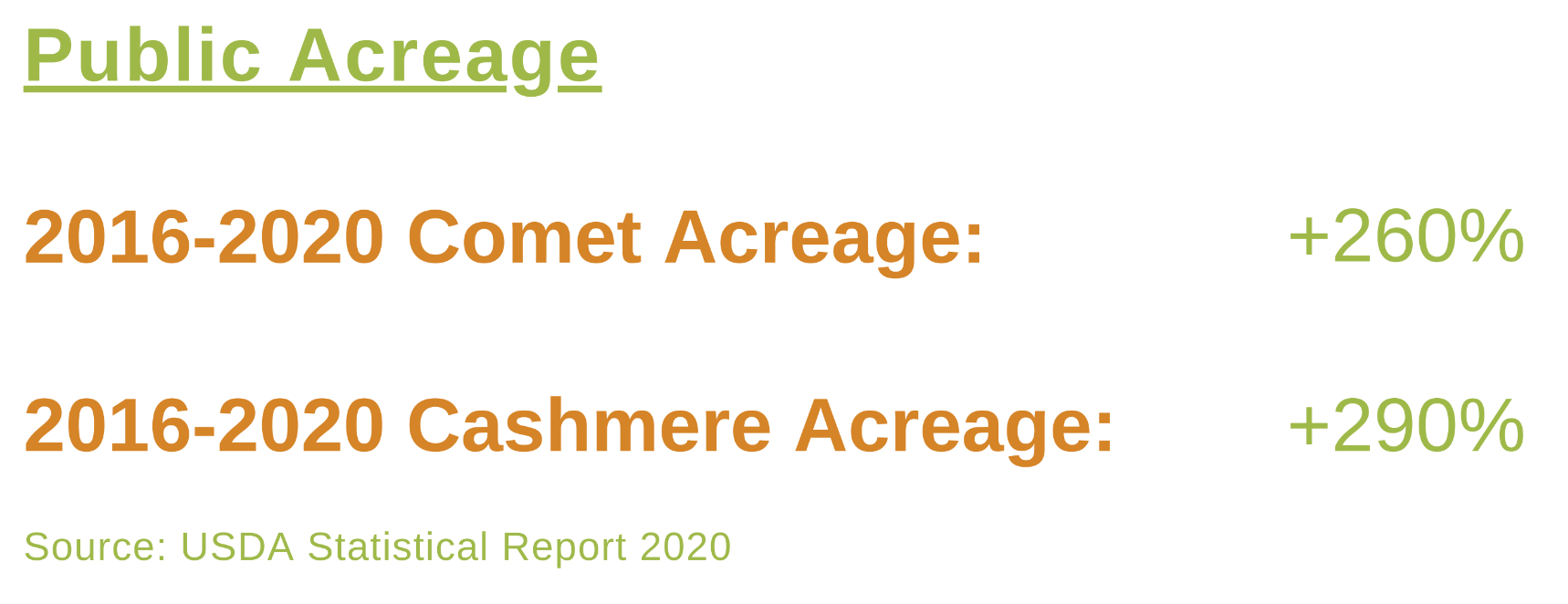

Using overall acreage as a baseline, total U.S. hop acreage has increased 16% since 2016, but previous proprietary hop variety leaders, Simcoe® and Amarillo®, have each declined in acreage during this period despite overall industry growth.

On the other hand, Citra® and Mosaic® have each grown almost 14x faster than baseline industry trend since 2016, and have now positioned themselves as the #1 and #3 varieties — acreage wise — in the U.S. The significance of this development cannot be overstated.

Much Greater Competition is Coming in the Proprietary Variety Space

New and upcoming proprietary varieties from a much wider owner and developer base are evolving fast.

El Dorado®, Idaho 7™, Strata™, and Azacca® — all separately owned proprietary varieties — have collectively increased over 300% in acreage from 2016 to 2020.

El Dorado® is already a top 10 variety, and with the continued growth trend of Idaho 7™, Strata™, and Azacca®, it is a safe bet that several more of these varieties will soon reach into the top 10 as well in the next few years.

Whereas in the past, the proprietary hop variety space was dominated by two to three hop breeders, there now exists, at a minimum, eight breeding programs capable of delivering new varieties, with the ability to scale, to the brewing industry.

Given current trends, within five years, we will see a more diversified proprietary variety ownership profile, with new varieties, from new ownership entities, attaining ever larger roles in the US hop industry.

Flickers of Hope from the Public Variety Space

Most in the industry are aware of the quickly declining acreages of Cascade, Centennial, and Chinook. Despite these high-profile declines, the public breeding program is seeing small successes arise.

Although these gains are coming from an extremely small acreage basis, they are, nonetheless meaningful. Be prepared to see the public breeding program release an increasing amount of flavor centric varieties in the next three to five years years as a renewed commitment to the public breeding program begins to slowly pay dividends.

In the short run, from a hop perspective, the 2020 crop was a challenge, but, given the extremely difficult conditions brewers encountered from COVID-19, the reduced crop will be a long term positive for both brewers and growers, as proper alignment between supply and demand can now be achieved with fewer dislocations to both sides.

Long term, the trends in the U.S. hop industry with proprietary varieties, while they may be concerning to some in the brewing industry, are nevertheless positive. New entrants are rapidly increasing competition in proprietary variety space, resulting in surging varietal options for brewers, from a widening supply base of growers and dealers.

The U.S. hop industry, with a blend of competitive, privately owned breeding programs, coupled with a revitalized public breeding program, is poised to be able to continue to swiftly bring new varietal choices to brewers, and scale them rapidly as needed.

In 2019 Brews News visited Eric at CLS Farms to discuss their support of public breeding programs, Zappa hops and a range of other topics.